can you go to jail for not filing taxes reddit

Press J to jump to the feed. You arent going to go to jail but yes you should file an amended tax return.

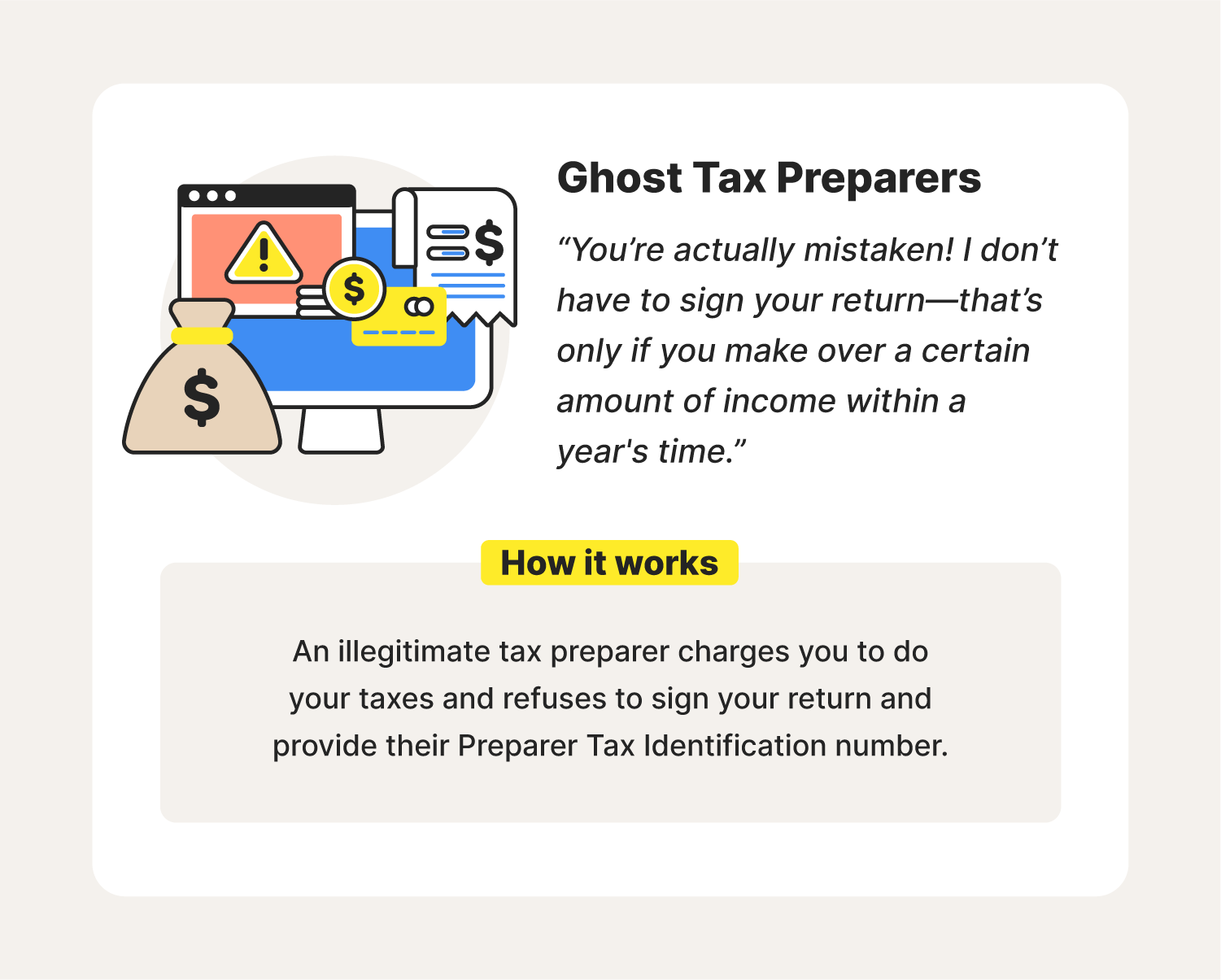

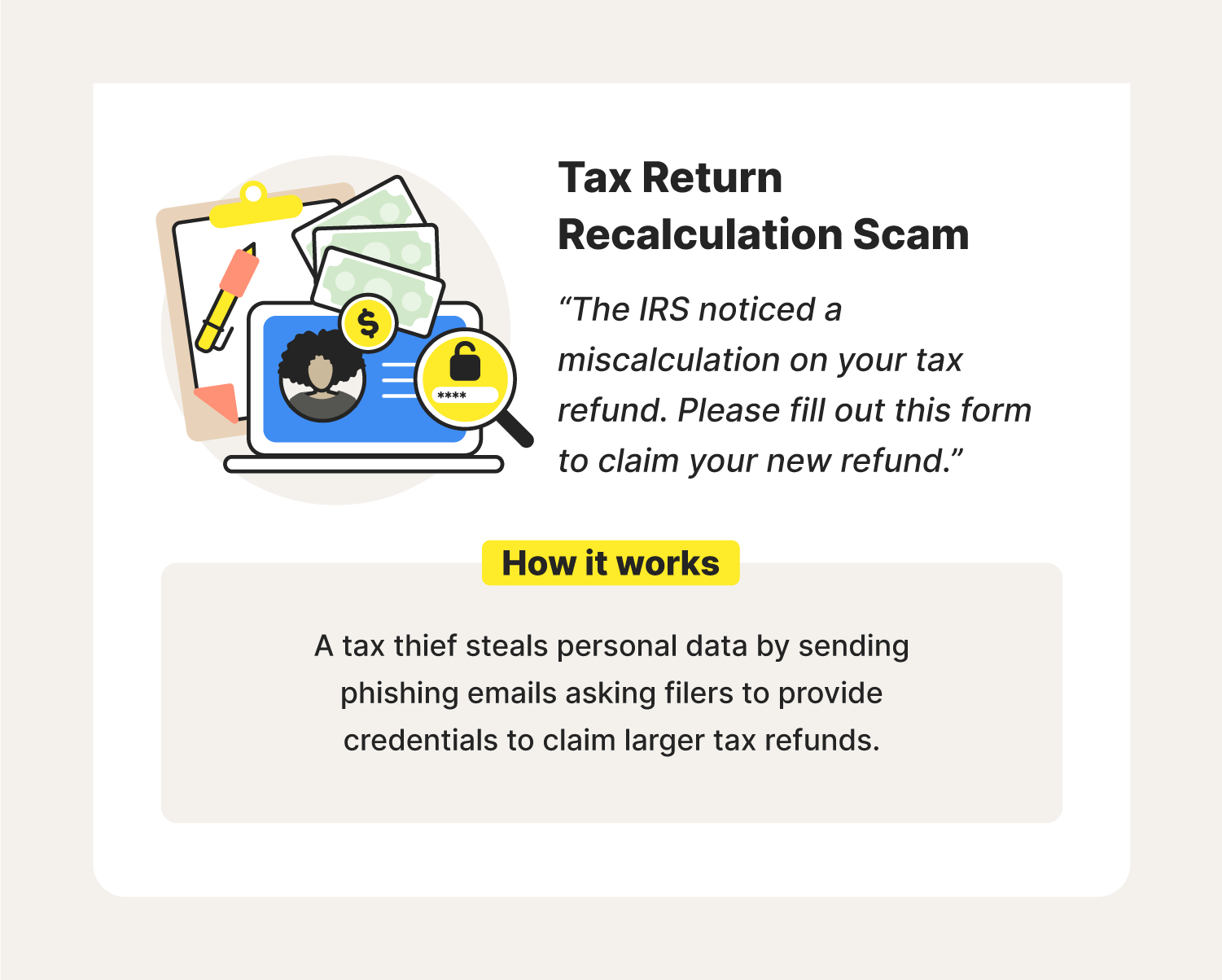

Irs Scams 10 Types How To File Taxes Safely In 2022 Norton

Press J to jump to the feed.

. Moral of the Story. Yes plenty of people go to jail for not paying taxes but whether it is likely to happen depends on a lot of circumstances. Whether a person would actually go to jail for not paying their taxes depends upon all.

Talk to an accountant. You may even face wage garnishment or property seizure. If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping.

You can go to jail for failure to file or failure to file accurately but not for failure to pay. The IRS will charge a penalty for failing to file taxes. But you cant be sent to jail if you.

Finally the IRS may have you jailed if you fail to file a tax return. Owing a correctly reported balance due will get you a world of penalties interest tax liens and levies but not incarcerated. Whatever the reason once you havent filed for.

While the IRS does not pursue criminal tax evasion cases for many people the penalty for those who are caught is. Which translates to 500 a month to the IRS for the next 6 years bad. Is It Possible to Face Jail Time for Unpaid or Unfiled Taxes.

If you were making 11 an hour you probably owe. A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve. Actively avoiding taxes out of protest definitely increases those odds.

There is not enough detail in your post to tell you how bad it is. Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount. The IRS Saves Criminal Prosecution for Exceptional Cases.

However you can face jail time if you. You can go to jail for lying on your tax return. People may get behind on their taxes unintentionally.

Yes You Can Go To Jail For Past. In the situation you describe jail would not be an option. There are stipulations to this rule though.

Jail time is usually reserved for those who criminally evade taxes. You can go to jail for not filing your taxes. Ballpark is it looks like it could be about 25-35k bad.

In fact you could be jailed up to one year for each year that you fail to file a federal tax return. But during that year I literally. You can go to jail for cheating on your taxes but not because you owe some money and cant pay.

It would take a lot for the IRS to put you in jail. Perhaps there was a death in the family or you suffered a serious illness. After that collection calls begin.

If he doesnt pay up then CRA can seize bank accounts and put liens on his property. In fact even an audit is highly unlikely to land you in jail. You might be able to make it right before the IRS even notices.

Not being able to pay your tax bill. In fact the IRS cannot send you to jail or file criminal charges against you for failing to pay your taxes. If you cannot afford to pay your taxes the IRS will not send you to jail.

Youre not going to go to jail dude. The short answer is maybe it depends on why youre not paying your taxes. The short answer to the question of whether you can go to jail for not paying taxes is yes.

With this in mind you should also. Posted in the kahntaxlawdotcom community. There was only 1 year that I didnt file my taxes and it was during the hay-day of my ignorance about finances.

However you cant go to jail for not having enough money to. If you fail to pay the amount you owe because. Beware this can happen to you.

However the government has. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that. Unpaid taxes arent great from the IRSs perspective.

Press question mark to learn the rest of the keyboard shortcuts. You could contact the Service at 1-800-829-1040 M - F 7am - 7pm. The short answer is maybe.

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Beware Failing To Pay The Irs Could Land You In Jail Tax Attorney Orange County Ca Kahn Tax Law

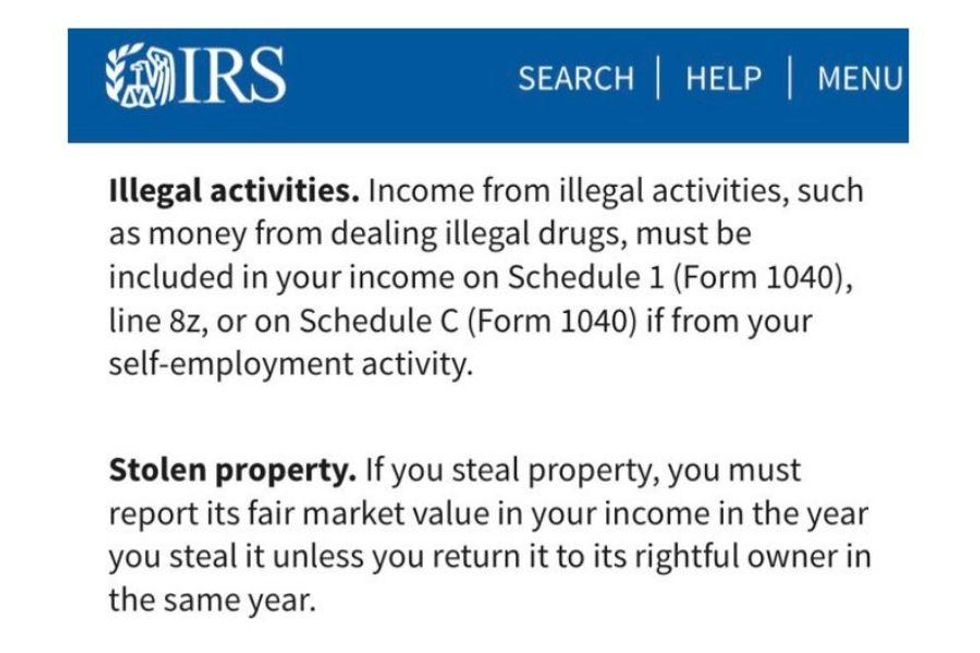

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Can I Go To Jail For Tax Evasion In North Carolina Dewey Brinkley Law

Who Goes To Prison For Tax Evasion H R Block

Penalties For Claiming False Deductions Community Tax

Can You Go To Jail For Not Filing Tax Returns Beware This Can Happen To You Tax Attorney Orange County Ca Kahn Tax Law

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Wesley Snipes Did Not Pay His Taxes And Went To Jail Tim Geitner Didn T Pay His Taxes And Became Treasury Secretary Now Charlie Rangel Didn T Pay His Taxes And Is Writing The

If You Go To Jail For Tax Evasion You Re Living Off Taxes Because You Didn T Pay Taxes R Showerthoughts

Lying On Taxes It S Always A Bad Idea Credit Com

The Richest 1 Percent Dodge Taxes On More Than One Fifth Of Their Income Study Shows

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Man Fighting Jail Sentence For Rigging Lottery So He Won 3 Times A Year

Can I Go To Jail For Unfiled Tax Returns Tax Resolution

No It S Not Your Money Why Taxation Isn T Theft Tax Justice Network

Irs Scams 10 Types How To File Taxes Safely In 2022 Norton

Tax Faqs Can You Go To Jail For Back Taxes Geaux Tax Resolutions